Article by Gabit Musrepov and Alexander Batrov in Investors’ Voice for the American Chamber of Commerce in Kazakhstan

Published in Investors’ Voice by the American Chamber of Commerce in Kazakhstan

1. Basic concepts related to the energy transition.

The energy transition is one of the most important tools for achieving Carbon Neutrality, a goal set by countries that have ratified the 2015 Paris Agreement on Climate Change. The main goal of the Paris Agreement is to strengthen the global response to the threat of climate change by keeping the increase in global temperature in the 21st century to no more than 2°C above pre-industrial levels while continuing efforts to limit the temperature rise to 1.5°C1.

The definition of energy transition refers to a major transformation of the energy supply and consumption mix, with a shift from a fossil fuel-based energy mix to one dominated by renewable energy mix (hereafter referred to as RES) with very limited carbon emissions2.

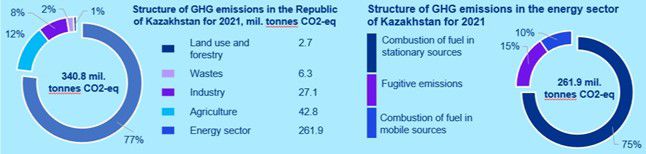

Decarbonisation (carbon reduction) of the energy sector is an important goal, as the energy sector traditionally accounts for a significant share of global greenhouse gas (GHG) emissions. In Kazakhstan, for example, the energy sector contributes more than 70% of total GHG emissions.

According to the analysis3 conducted in 2021, the energy sector in Kazakhstan was responsible for 77% of emissions, i.e., 261.9 million tons of CO2-eq. with 75% of these emissions operating from stationary sources of fuel combustion, particularly power generation facilities).

A significant contribution to the decarbonisation of the energy sector is the electrification of end-users who can receive electricity from renewable energy facilities, leading to reduced GHG emissions in other sectors, such as the transport. In contrast, energy efficiency improvements, reduction in electricity losses and increased digitalization in electricity distribution will enhance efficiency and decrease overall energy consumption4.

Given the extensive use of fossil fuels in different countries, the energy transition is expected to be a gradual and complex process, even in developed countries. Besides increasing the share of renewables, carbon-intensive energy sources need to be replaced by low-carbon sources (e.g. decreasing oil consumption while increasing the use of LPG and biofuels).

2. Impact of the energy transition on fossil fuel consumption

The oil and gas industry, which supplies around half of the world’s fossil fuel consumption, is highly susceptible to both risks and opportunities arising from the energy transition.

Global oil consumption declined by 7% over the period 2019-20205, coal consumption fell by 4,4%, and natural gas consumption decreased by 2,8%. Experts predict that oil consumption will drop to 14 million barrels per day by 20506 from the current level of 102.43 million barrels per day7. Oil consumption has been increasing in recent years: in 2019, global oil consumption was 97.96 million barrels per day, and in 2025 oil consumption is forecast to reach 103.81 million barrels per day. However, the share of oil in the global energy consumption mix has decreased significantly. According to SPGlobal, in 2023 the share of oil was 33%, peaking at 50% in 19738.

This suggests that the share of RES in the global energy consumption structure is increasing. By 2023 wind and solar energy accounted for 13,2%9 of global energy consumption, while fossil fuel usage continues to decline in percentage terms (though it may still grow in absolute values). In Kazakhstan, the share of RES in the energy mix in 2023 was 5,97%10, electricity generation by RES facilities in 2023 total of 6,675,5 million kWh. The installed capacity of RES facilities in 2024 is 2,903.54 MW11 and in 2014 was only 178 MW, i.e. over 10 years of growth of RES facilities in Kazakhstan the share of RES facilities has increased more than 16 times.

According to the International Energy Agency (IEA)12, in 2022 the world consumed about 97 million barrels of oil per day and 4,150 billion cubic meters of natural gas. This led in GHG emissions of just over 18 Gt, representing roughly half of the total GHG emissions from the energy sector. The recent development of clean energy technologies suggests that oil and gas demand will peak by 2030 under the Sustainable Policy (STEPS) scenario, after which a gradual decline is projected.

The transition to net zero requires a significant acceleration in the deployment of clean energy technologies and a more rapid reduction in the use of oil and gas.

The IEA’s Net Zero by 2050 report13 in the scenario of achieving carbon neutrality by 2050: The energy mix in 2050 is more diverse than today. Renewable energy sources provide two-thirds of energy consumption in 2050, split between bioenergy, wind, solar, hydroelectric and geothermal. In addition, nuclear energy supply will increase significantly, almost doubling between 2020 and 2050.

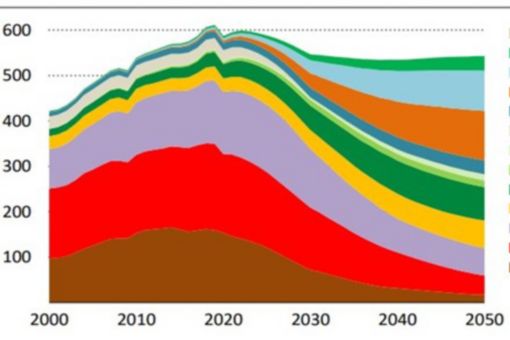

Total energy supply in the Net Zero Emissions scenario according to IEA, in Exajoules

The share of fossil fuels in the total energy mix will fall from 80% in 2020 to just over 20% in 2050. However, their use will not fall to zero in 2050: significant amounts are still used to produce non-energy goods, carbon capture and utilization storage (CCUS – Carbon capture and utilization storage) technologies will be used and in sectors where emissions are particularly difficult to reduce, such as heavy industry and transport. All remaining emissions in 2050 are offset by carbon capture and utilization technologies and climate projects (e.g., carbon sequestration in forest ecosystems). Coal use will fall from 5,250 million tons of coal equivalent in 2020 to 2,500 million tons of coal equivalent in 2030 and to less than 600 million tons in 2050 – an average annual decline estimated at 7% per year. Oil demand will fall to 72 million barrels per day in 2030 and 24 million barrels per day in 2050 – an average annual decline of more than 4% through 2050. Natural gas use peaks in the mid-2020s and then begins to decline as it is phased out in the power sector. Natural gas use declines to 3,700 billion m3 in 2030 and 1,750 billion m3 in 2050 – an average annual decline of just under 3% per year.

Cumulative global GHG emissions associated with energy and industrial processes from 2020-2050 would be just over 460 Gt in the Net Zero scenario. Assuming that there are parallel reductions in GHG emissions from agriculture, forestry and other land uses in the period, the cumulative emissions from this sector would be around 40 Gt CO2e by 2050, i.e. a cumulative GHG emission of around 500 Gt, which is consistent with the IPCC SR1.5 climate scenario, which states that the total GHG emissions from 2020 providing a 50% probability of limiting warming to 1.5°C is 500 Gt CO2e (IPCC, 2018).

3. Impact of energy transition on prices and changes in consumer structure for the oil and gas industry

The implementation of scenarios aimed at reducing GHG emissions is associated with stricter regulatory standards on the part of national governments, as well as trends related to changes in the investment structure when investors are increasingly investing in green energy projects (including hydrogen projects), while investments in the development of fossil fuels will be reduced – this will directly affect the oil and gas industry.

The oil and gas industry will need to adapt to the changes by adopting more energy-efficiency technologies, implementing the best available technologies to minimize negative environmental impacts, carbon capture and storage technologies (CCUS, Direct Air Capture), and building on the practical results achieved in reducing GHG emissions in cooperation with stakeholders. To withstand the increasing level of competition, oil and gas companies will need to increase their own investments to implement decarbonization programs and sustainable development practices.

As an example of carbon regulation that in the future will have a direct impact on the oil and gas industry in Kazakhstan, the CBAM (Carbon Border Adjustment Mechanism), the European Union’s mechanism for cross-border carbon regulation, will impose additional duties on groups of goods supplied to the EU depending on the amount of greenhouse gas emissions emitted into the atmosphere during production and the level of carbon tax paid in the country where the goods are produced. Although oil and petroleum products are not subject to these duties for 2025-2026, when CBAM is scheduled to be launched, the trend shows that these duties will be extended to the oil and gas sector in the future. As the EU is Kazakhstan’s main trading partner (40.5% share of exports to EU countries14), it can be concluded that Kazakhstan will have to adapt to the new measures the medium term, either by reconfiguring its oil export structure or reducing oil production.

The introduction of new technologies and practices will increase production costs and, consequently, the selling price of oil and gas to consumers, while the price threshold for profitability will be determined by the demand and purchasing power of major consumers. Fossil fuel consumers will also be affected – large consumers will also have to comply with best sustainability practices. Given the trend towards stricter regulatory mechanisms for fossil fuel suppliers, the main consumers will be developing and undeveloped countries where there is no global climate agenda (no comprehensive decarbonisation programs or carbon neutrality targets). Therefore, much will depend on the purchasing power of these countries and the cost of oil production: in the future, these countries will not be able to pay the oil price that developed countries can afford and will reduce their purchases of oil products, while oil will no longer be in high demand in developed countries as renewable and low-carbon energy sources will account for a large share of energy. Major oil and gas suppliers need to take this into account and diversify their economies by developing other sectors and implementing the energy transition by increasingly developing the renewable energy industry and switching to low-carbon energy sources.

It is important to note that the implementation of the energy transition presents not only challenges and constraints but also new jobs and opportunities for oil and gas companies to invest in RES, energy efficiency technologies, best available practices in the decarbonisation sector (carbon capture and storage technologies, use of hydrogen to replace fossil fuels), development in the development and implementation of climate projects and other practices aimed at achieving carbon neutrality. Therefore, in adapting to the energy transition, oil and gas companies will need to overcome emerging challenges: change their management approach, set new company priorities in environmental aspects, and develop sustainable development practices in cooperation with stakeholders (consumers, suppliers of new technologies, logistics companies and others). The energy transition for the oil and gas industry is a complex process that requires assessing risks from emerging challenges and developing a comprehensive development strategy for the long term so that companies in this field can successfully adapt and remain sustainable in changing market conditions and global trends aimed at minimizing climate change.

1 Key aspects of the Paris Agreement | UNFCCC

2 Despite the fact that RES do not emit CO2 emissions into the atmosphere during operation, energy storage systems are not yet able to fully solve the problem of energy storage and utilization during periods when there is not enough, for example, sunlight or wind for electricity generation by RES facilities. Therefore, in an energy system with a major share of renewables, a certain percentage of power generation is allocated to shunting capacity – power generation facilities running on conventional fossil fuels (e.g. low-carbon energy sources such as natural gas or liquefied natural gas), which are needed to reliably supply consumers with energy during peak load periods or weather conditions when renewable energy facilities cannot generate the required amount of electricity. Limited carbon emissions in the RES energy mix will be associated with the operation of conventional-fueled shunting facilities, and CO2 emissions will be present in the production and logistics processes of RES facilities and their components

3 National statistic of Kazakhstan

6 The future of oil in 2050 – Opinion by Vinni Malik | ET EnergyWorld (indiatimes.com)

7 https://www.eia.gov/outlooks/steo/report/global_oil.php

9 Renewables – Energy System – IEA

10 QazaqGreen |

11 https://www.gov.kz/memleket/entities/energo/press/news/details/736134?lang=ru

13 Net Zero by 2050 – A Roadmap for the Global Energy Sector (iea.blob.core.windows.net)

Contact

Gabit Musrepov

Partner, Consulting GRCS & ORS

KPMG Caucasus and Central Asia

Source : kpmg

Discover more from Impact Newswire

Subscribe to get the latest posts sent to your email.